"Bookkeeping For Beginners" by Logan K. Miller is your comprehensive guide to mastering the essentials and advanced techniques of bookkeeping. Overwhelmed by business finances? This book demystifies accounting terms and procedures, providing clear explanations of fundamental principles and advanced strategies. Learn how to streamline your financial management, ensure compliance with legal requirements, and gain valuable insights into your financial situation. From practical tips and real-world examples to expert guidance on navigating tax laws, this book empowers you to make informed business decisions, increase efficiency, and drive growth. Take control of your financial future and confidently manage your business finances with this easy-to-understand guide.

Review Bookkeeping For Beginners

This "Bookkeeping For Beginners" by Logan K. Miller really exceeded my expectations! I went into it feeling the familiar dread that accompanies tackling something like accounting – a subject that’s often presented as overly complicated and intimidating. The book description accurately reflects the anxieties many entrepreneurs, like myself, face when it comes to managing their finances. That constant worry about making mistakes, about missing crucial deadlines, about navigating the labyrinthine world of tax regulations… it's enough to keep anyone up at night.

But this book doesn’t just acknowledge those fears; it actively dismantles them. The writing style is refreshingly clear and approachable, avoiding the dense jargon that often plagues financial texts. Miller masterfully breaks down complex concepts into digestible chunks, making even the “advanced techniques” feel achievable. I particularly appreciated the inclusion of real-world examples – those practical tips and insights were invaluable in helping me visualize how to apply the principles in my own business.

It's not just a theoretical overview either; it's a practical guide. The book provides a solid foundation in the fundamentals, covering all the essential terminology and concepts, but it doesn't stop there. It goes beyond the basics, exploring strategies to streamline financial management, and offering crucial advice on ensuring compliance with relevant regulations. This comprehensive approach is what sets it apart. Many books focus solely on the theoretical side of bookkeeping, leaving readers feeling lost when it comes to actual implementation. This one bridges that gap beautifully.

I found the structure incredibly logical and easy to follow. Each chapter builds upon the previous one, creating a natural progression of learning. It feels less like a textbook and more like a supportive guide, walking you through the process step-by-step. The author’s friendly and encouraging tone is a significant contributor to this feeling; it's like having a knowledgeable mentor beside you, patiently explaining everything. There's a real sense of empowerment that comes from understanding these principles and gaining confidence in managing your own finances.

The book's impact has been tangible. I feel significantly more confident in my ability to handle my business finances. Before reading it, the thought of tax season filled me with dread. Now, while I’m not claiming to be an expert overnight, I feel equipped with the knowledge and tools to navigate the process with much greater ease and understanding. It’s about more than just avoiding costly mistakes; it's about gaining the financial clarity needed to make informed decisions that can propel my business forward. It’s about freeing up mental space and energy that was previously consumed by financial anxieties. In short, this is a truly valuable resource for anyone – from complete beginners to those looking to refine their existing bookkeeping skills. I wholeheartedly recommend it.

Information

- Dimensions: 8.5 x 0.21 x 11 inches

- Language: English

- Print length: 89

- Publication date: 2024

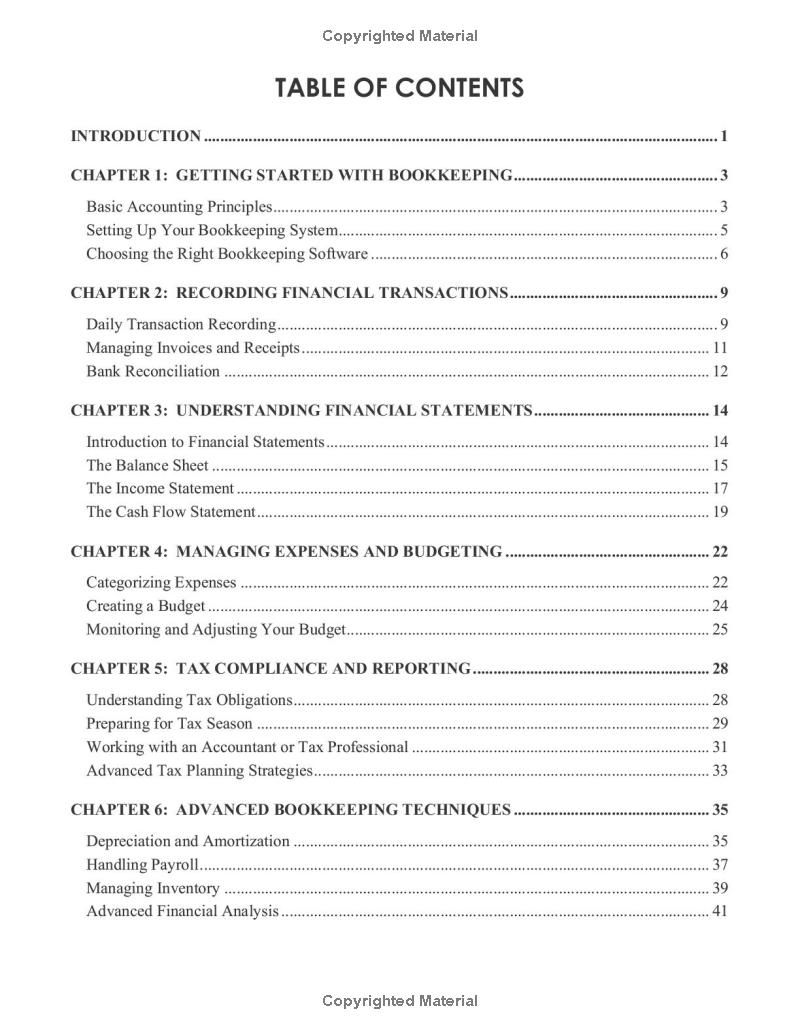

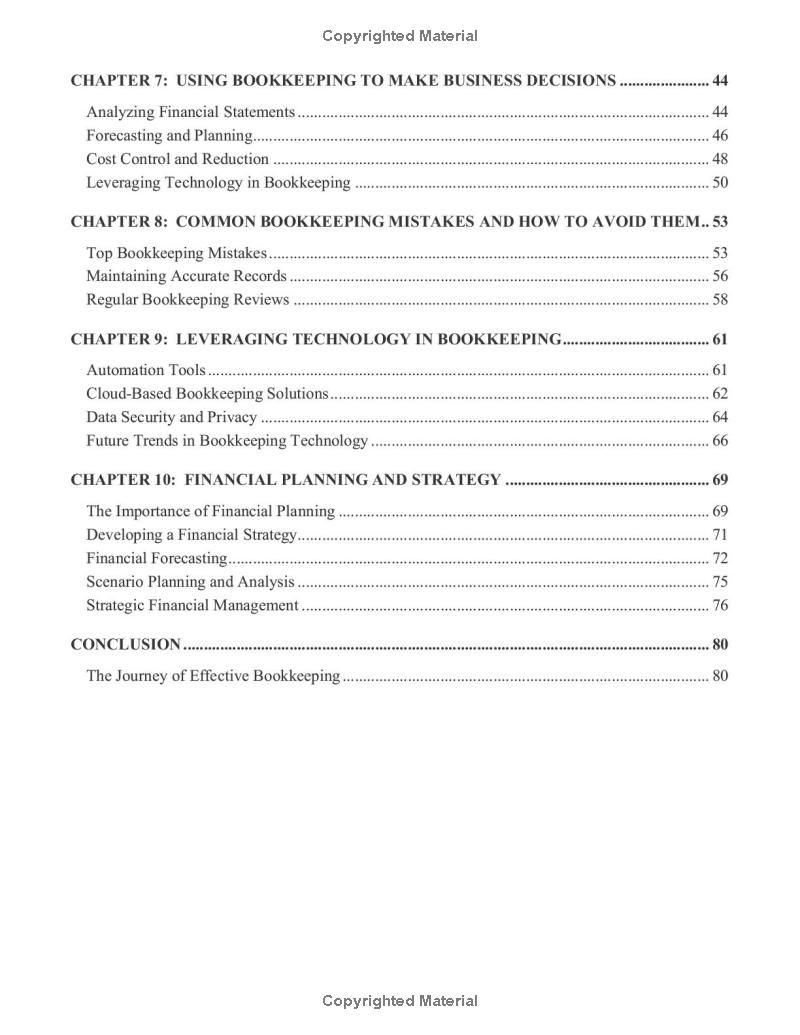

Book table of contents

- INTRODUCTION

- CHAPTER I: GETTING STARTED WITH BOOKKEEPING

- CHAPTER 2: RECORDING FINANCIAL TRANSACTIONS

- CHAPTER 3: UNDERSTANDING FINANCIAL STATEMENTS

- CHAPTER 4: MANAGING EXPENSES AND BUDGETING

- CHAPTER 5: TAX COMPLIANCE AND REPORTING

- CHAPTER 6: ADVANCED BOOKKEEPING TECHNIQUES

- CHAPTER 7: USING BOOKKEEPING TO MAKE BUSINESS DECISIONS

- CHAPTER 8: COMMON BOOKKEEPING MISTAKES AND HOW TO AVOID THEM

- CHAPTER 9: LEVERAGING TECHNOLOGY IN BOOKKEEPING

- CHAPTER 10: FINANCIAL PLANNING AND STRATEGY

- CONCLUSION

Preview Book